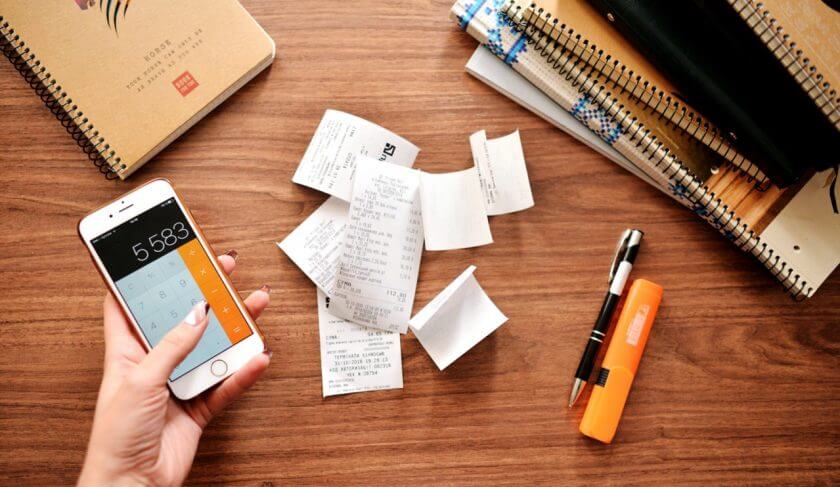

Have you wondered about which payment type is best if you’re trying to stick to a budget? Then you are on the right track. Here are the lists of…

According to professional investment bankers using a debit card is the best payment method. If you want to maintain your personal budget, then it is good to use a debit card.

It has been considered that debit cards should be the top priority because it helps you to spend limited budgets.

You can easily track the monthly payments because the debit card is linked to your online account. Therefore, it is an advantage for you to analyze the monthly payment records. Your debt payments will display on your computer screen, and you can monitor it anytime, anywhere you want.

In this article, we are going to discuss a few payment types which are best for you if you want to stick to a budget.

Table of Contents

The Best Type Of Payment If You Are Trying To Stick To A Budget

Below we have mentioned some of the payment methods which will help you to stick to your budget. Not only that, you can track your spending money and credit score.

1) Cash Payment

If you can make your payments in cash, then it is an appropriate thing to do. If you can make payments in cash then it is a great thing. Usually it is easy for you to track records alongside you can segment the money for the individual sector. This means there is an organized calculation of how much money needs to be spent on which realm.

Another benefit of cash payment is while you are withdrawing some amount of money that time it notifies you about the right amount of cash. Apart from that, distributing cash money at the beginning of the month helps you to stick to the budget.

Those Who Didn’t Carry Cash May Face These Problems

There are some benefits if you carry cash otherwise you may face these issues. Actually, cash is a handy solution for certain moments.

- Sometimes it happens that you have to spend a minimum amount of cash as there is no facility of using credit cards.

- While you are purchasing a lot of products then you have to pay some small changes for utilizing the plastic bag.

- If you are not carrying cash then you are unable to pay tips no matter if it is a restaurant or a mall. In this situation you can’t use your ATM card.

- You may have to face some situations for withdrawing money in case you didn’t find any ATM near your locations. Then it will be a burden for you.

2) Use Paypal And Similar Platforms

In recent years PayPal has attracted numerous competitors like Stripe and Payoneer. This payment method is one of the easiest ways to transact your money. It basically allows for online payments. Debit cards are also issued by PayPal.

3) Money Order Method

One of the key advantages of a money order method is that it is more secure than any other way. It also doesn’t need any bank for money transactions. It is a cost-effective and impactful method.

Money Order can also guarantee you for paying the money to the recipient. But the thing is that you have to purchase the money in order to begin your payment with this technique.

4) Write A Check

One of the traditional ways for payment is to write a check. This traditional payment option is still everywhere. However, now the current world has become digital, so you have to give extra effort to make a physical and digital record of the check.

It is a great idea if you can save the check stubs, but alongside, you have to transfer the records to a budgeting system.

5) ACH Payments

The ACH is known as Automated Clearing House. The way of transferring the money is directly deposited. This system is also checking the transaction record of the account and the automated transferring of the money on a specified date.

Additionally, you can also set your ACH payment account as an automated monthly payment. With the help of autopay, you can check your account balance to avoid overdraft payments due to a lack of funds.

You Can Use A Debit Card To Stick To Your Budget.

The debit card is like an electronic token because it has financial freedom with responsibility. While student loans. In this case, once your debit account is filled with thousands of dollars, then you can switch to stricter budgeting and Best Mobiles.

It is a great idea to use debit cards for everyday expenses as well as beyond your budget can help you to obtain your existing goals.

Last Words

Above, we have mentioned some of the payment options. By using those options, you can stick to your budget. Basically, the thing is, the more you can organize your payment technique, the easier it will be for you to handle the budget.

There are also several methods of paying, such as using credit cards, mobile wallets, apple pay, and so on. In this case, you have to finalize your budget system. Otherwise, it won’t be possible for you to proceed further.

We hope you found this article helpful. In case you have queries, you can comment down below.